These clients want to see who is in charge of their funds. Not everyone trusts ATM machines some people believe they are confusing and dangerous. Passbook savings accounts, according to some, provide safer transactions. Advantages of Bank Passbook Transactions that are more secure The signature on the withdrawal slip would be compared to the signature in the book at the paying branch, which required a special UV reader to read. Nowadays, customers are more likely to be verified using a PIN and an automated teller machine. The owner of the passbook would sign in invisible ink in the back of the book, and the signing authorities would be noted as well. Banks implemented the black light signature system for passbooks in the 1980s, allowing withdrawals from passbooks at locations other than the one where the account was started, unless previous arrangements were made to move the signature card to the other branch. If the account holder was unknown to the teller, the signature on the slip and the authorities were compared to the signature card on file at the branch before money was released.

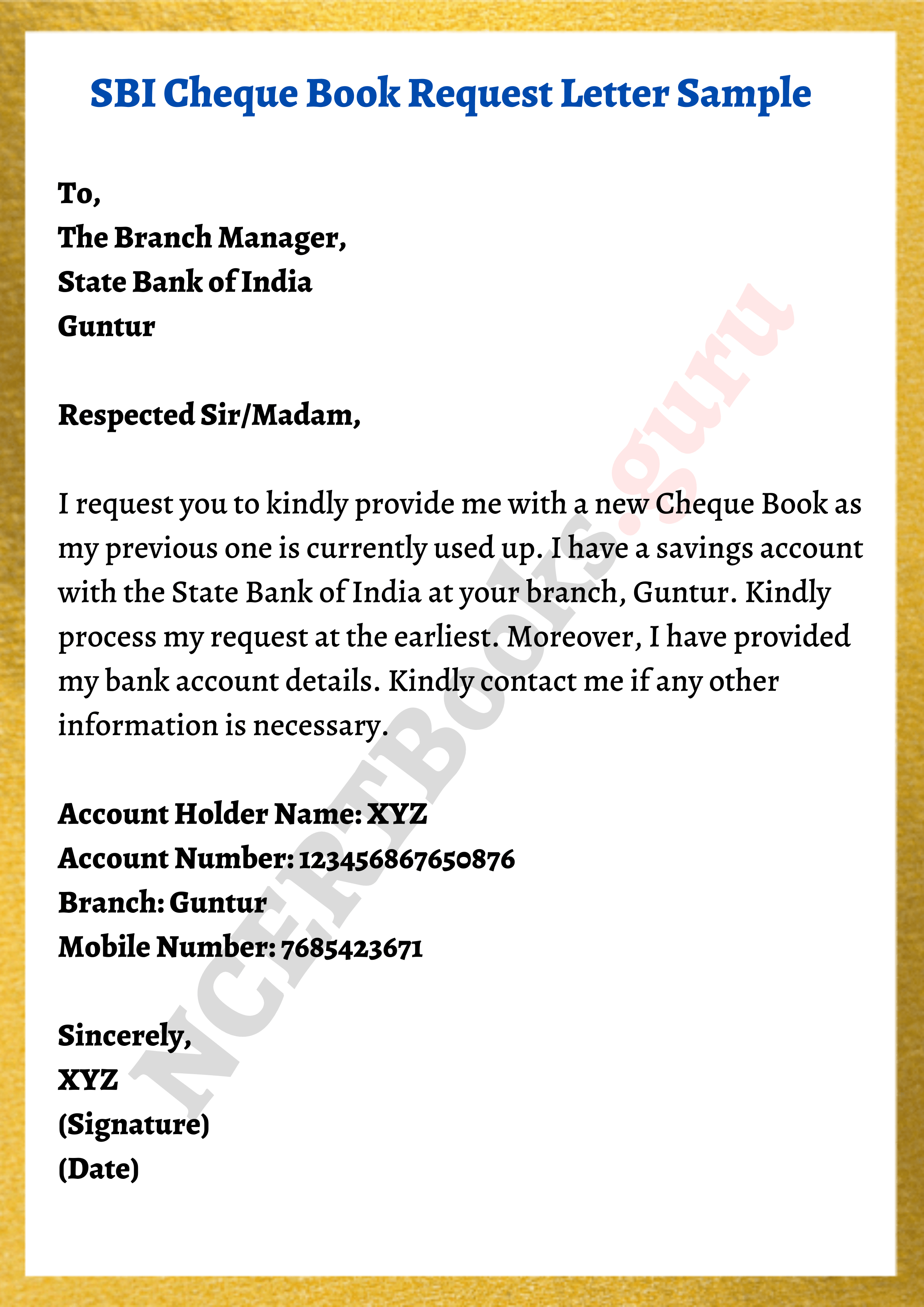

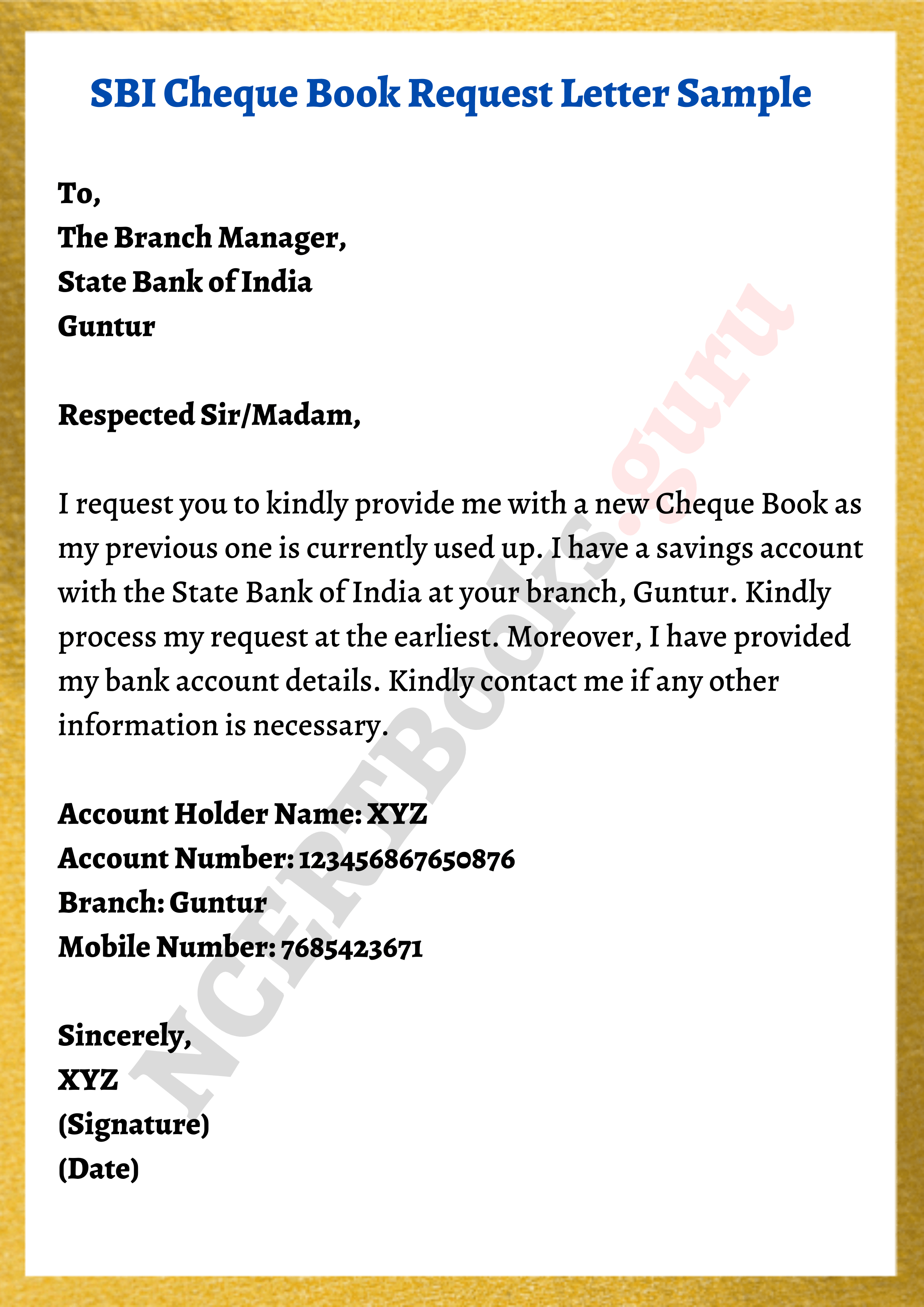

Debits and Withdrawals- Withdrawals usually required the account holder to go to the branch where the account was housed and sign a debit or withdrawal slip. A passbook is used by an account holder to keep track of their bank transactions. The teller at the bank counts and checks the cash and details if everything is in order, the deposit is credited to the account the credit slip is then maintained by the bank the credit slip booklet is then stamped with the date and returned to the account holder. The total amount of each note and coin is counted and recorded on the slip, along with the date and who it was paid in by. Credits and deposits- The account user can fill out a tiny credit slip or deposit form to add credit to an account by bringing cash to a bank in person. To balance their accounts, bank customers would utilize a cheque book and a passbook. Passbooks are essentially a throwback to a pre-internet era of banking when, in the absence of computers and SMS notifications, you had to keep precise paper-based records. Any loan-related information, including the payment method, would go here as well. Similarly to credit transactions, you’d keep track of deposit interest, third-party receipts, and cash deposits in your passbook. All direct debit and pay order information, as well as facts regarding self-payments to other accounts, would be recorded. Functioning of PassbookĪ bank passbook is merely a physical record of your transactions, but what kind of data should be kept? For debit transactions, you’d provide all payment information, such as the payee’s name, the mode of payment, and the bank that made the transfer. A passbook savings account, for example, includes both a physical notebook to record transactions and attractive interest rates.

While most banks now provide paperless alternatives to the old-fashioned passbook, some accounts still require a passbook. It keeps track of all banking activities on paper, including specifics like account numbers. What is a Passbook?Ī bank passbook is a tangible notebook used by bank account users to keep track of their finances. But, if you want a more traditional method, what are your options? A passbook savings account is something to think about. Because of the widespread availability of mobile wallets and banking apps, most of us no longer visit a bank.

Banking has progressed significantly throughout time.

0 kommentar(er)

0 kommentar(er)